The recently published report from Adjust “The Shopping App Insights Report: 2025 Edition” provides valuable data for e-commerce and shopping apps. As a mobile app promotion agency, we analyzed this document to answer a key question: how do you grow in an environment where installs are falling and the cost of traffic is rising? We highlighted key trends, metrics and strategies and showed how they can be applied to optimize your campaigns. The report covers global and regional data from January 2023 through May 2025, based on analysis of the top 5,000 apps and the full Adjust dataset. Let’s understand what the market is in 2025 with AdKeys team.

Mobile Commerce: a Market that Cannot Be Ignored

Global online sales are expected to reach $6.42 trillion in 2025, with mobile commerce accounting for more than $2.5 trillion. That means that one in five retail dollars will be spent online, and increasingly through mobile devices.

But the growth is uneven: new tariffs in the U.S., shopping slumps in some countries, and changing user habits are making the market more complex. Shoppers are bouncing between apps, mobile web, social networks and even voice assistants. Their path to purchase is becoming increasingly “broken”, and the main task for brands is to remove barriers along the way.

Top Trends 2025: What's Changing the Market Right Now

1. AI—from a toy to a real growth tool

AI has long ceased to be a hype and has evolved into a powerful tool for automation and real-time decision making. How it’s being used:

- Creatives and personalization: AI optimizes creative creation and variant testing, saving thousands of hours previously spent on routine tasks. It also analyzes user behavior (searches, baskets, views) and immediately adapts ad formats and recommendations to increase relevancy and conversion potential.

- Performance Optimization: AI-based predictive models help predict demand, identify valuable customer segments, and fine-tune channel spend.

- User engagement (UA) in the face of privacy restrictions: In the face of tightening privacy regulations (e.g., Apple ATT, cookie deprecation), AI enables marketers to use techniques such as predictive modeling and cohort analysis to evaluate the effectiveness of campaigns without user-level tracking.

- Prediction: AI tools help marketers by predicting demand spikes, automatically adjusting bids and budgets, and dynamically tailoring messages for multiple platforms simultaneously.

Example: Shopify Magic saves companies up to 20 hours a month on sales forecasting and can increase traffic by 40%.

Practical tip: Use AI to the max. Start small—automate A/B tests or personalized fluff. Next, plug in predictive models for segmentation and forecasts.

2. Fast delivery becomes the standard

Quick commerce (ultra-fast delivery) is creating a habit among users to receive goods immediately. Quick commerce revenue is projected to reach $195 billion by the end of 2025

What this means: users are starting to demand speed not only from couriers, but also from app interfaces, ad campaigns, and support chat.

Practical tip: optimize your UX for the “bought in two clicks” scenario. Remove unnecessary steps, add autocomplete data and quick payment methods.

3. Voice and chatbots as new points of sale

The voice commerce market is expected to grow to $151.4 billion in 2025. Voice assistants (Alexa, Siri, Google Assistant) are increasingly becoming the entry point to shopping. And AI chatbots are no longer just support, but full-fledged salespeople: they help select products, assemble a shopping cart, and even make upsells, thus increasing the average check and reducing churn.

Sephora case: the company has integrated voice search via Google Assistant. Users can “order lipstick” by voice, and the system immediately suggests products in the app.

Practical tip: check if your catalog is optimized for voice search. And give the chatbot the functions of a “smart assistant”, not just a directory.

4. DTC brands are moving into apps

Direct-to-consumer companies are betting on their own apps to collect more first-party data and build loyalty. In the U.S., DTC sales through e-commerce will reach $187 billion in 2025.

Nike Run Club case study: Nike uses its app not only for sales but also for engagement (workouts, Challenges). This gives control over the data and direct communication with customers, which builds long-term relationships.

Practical tip: If a brand already has an audience, then an app is a good way to increase LTV and control of the customer experience. Add reward programs, personalized picks and unique content there

Where is Growth and Where is Stagnation

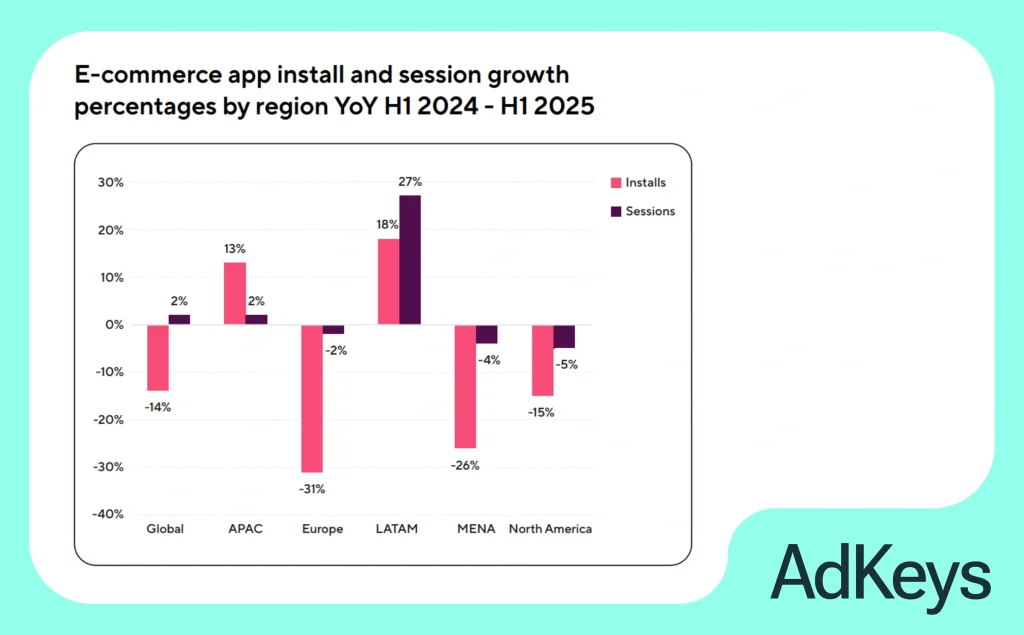

In 2024, e-commerce app installs grew by 16% and sessions by 11%. But in the first half of 2025, installs fell 14%, while sessions grew 2%. That is, there are fewer new users, but they are more active.

- Leaders: LATAM (+18% installations, +27% sessions), APAC (+13% and +2%).

- Outsiders: Europe, MENA and North America.

- Record holders: Thailand (+180% of installations), Brazil (+48%), Malaysia (+69%).

- Anti-record: UAE (-79%), Saudi Arabia (-55%).

Conclusion: growth is highly dependent on the region. Where the market is saturated (US, Europe), you need to fight for retention and ROI. In growing countries (LATAM, SEA)—work more aggressively with attraction and localization

User Behavior: Less Organic, Shorter Sessions

- Shopping apps account for 76% of all installs, but they generate only 36% of sessions.

- Marketplace apps generate 60% of sessions with 20% of installs – users return more often.

- Average session shortened to 9.89 minutes, Day 1 retention dropped to 13%.

- Paid UA is growing: global paid/organic ratio rose to 0.54(shopping apps have 0.58). In Indonesia, paid installs exceeded organic for the first time (1.56)

Amazon case: the company tested push notifications with personalized selections. Conversion to repeat purchase increased by 22%.

Practical tip: don’t chase cheap installs. Focus on traffic quality and return mechanics—use gamification, cashback, notifications, discounts on repeat orders and personalized offers.

Advancement Economics

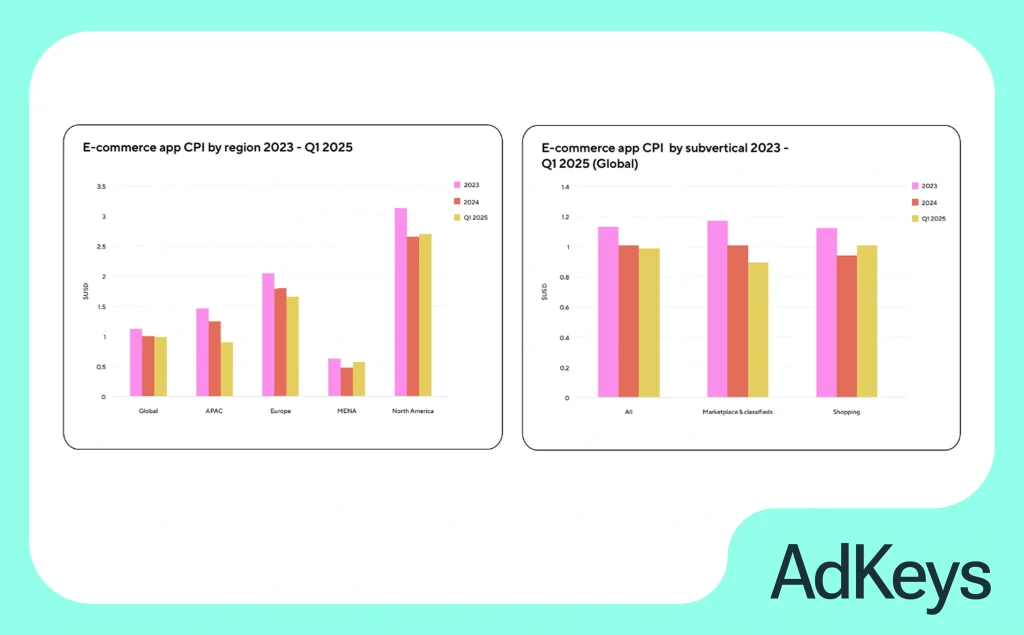

- CPI stabilized around $1, but with strong variation: $2.7 in North America and $0.9 in APAC

- CPC increased by 23% (up $0,16) especially in shopping apps ($0,15)

- CTR remains stable around 2% globally, but is up to 3% in the US.

- ARPMAU (average revenue per active user per month) declines globally ($7.8 in 2024 vs. $8.7 in 2023), but grows in LATAM and APAC (e.g., $14.05 in Thailand).

Conclusion: the advertising market is getting more expensive and revenue per user is not always growing. This makes it relevant to test new channels, partnerships and monetization models.

Practical tip: try hybrid models—subscriptions, in-game mechanics, in-app advertising. This reduces the dependence on CPI. Calculate ROI not by installs, but by LTV. Sometimes it’s more expensive to attract, but cheaper to retain.

Four Top Tips for 2025

- Localization and flexibility

Every country has different triggers and barriers. In Latin America people are sensitive to discounts and cashback, in Asia gamification is important, in the US convenience of delivery is important. - Start preparing for Q4 early

Black Friday, Singles’ Day and Christmas are major sales peaks, but users start buying earlier. - Retention is more important than installation

A low install price doesn’t guarantee a valuable user. Prioritize quality traffic and user retention mechanics. - Focus on omnichannel strategies: users find products via voice search, TikTok, YouTube, mobile web or offline QR code point. The brand’s task is to remove friction from the customer journey: from the web to the app, from advertising to the shopping cart.

Conclusion

In 2025, the mobile commerce market is unfortunately no longer simple. Apps need to simultaneously address the challenges of attracting, retaining, and monetizing quickly and skillfully.

Success no longer depends on a single metric—it requires an omnichannel approach, a deep understanding of regional specifics, and maximum use of AI to optimize every stage of the funnel.

The AdKeys team knows how to turn these trends into your real growth. We don’t just run ads, we build effective strategies that deliver high LTV and consistent revenue

Our experts are ready to:

- help brands with AI optimization of campaigns,

- build omnichannel scenarios (web → app → offline),

- build retention and retribution strategies,

- test new growth and monetization channels

.