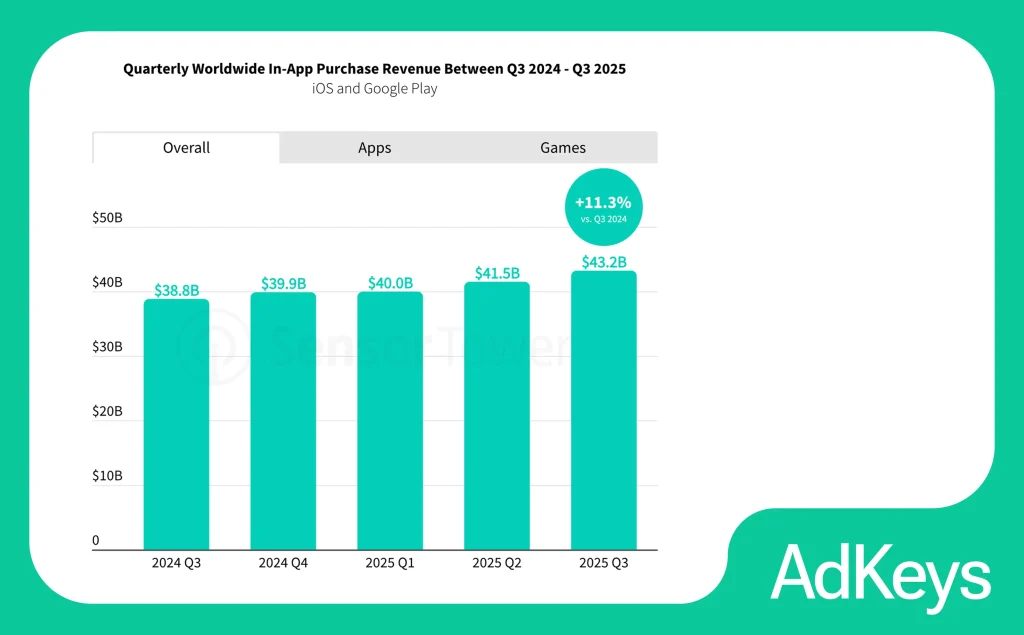

The third quarter of 2025 can be characterized as a period of final consolidation of new post-pandemic trends. The market has ceased to be simply a “battlefield” for users and has moved into a phase of mature monetization through complex products. According to a report by Sensor Tower, global consumer spending on in-app purchases (IAP) reached a historic high of $43.2 billion, up 11.3% from the same period last year.

However, these are not just pretty numbers; behind them lie structural shifts: a change in genre leaders, a redistribution of advertising budgets due to macroeconomic factors, and the explosive growth of artificial intelligence technologies. For AdKeys Digital clients and partners, we have analyzed Sensor Tower’s “Q3 2025 Digital Market Index” report so that you can adjust your promotion and monetization strategies for the coming months.

Mobile Market: A Paradigm Shift

Non-gaming apps now reign supreme

For a long time, the mobile market axiom was: “Games make money, apps build audiences”. In 2025, this paradigm was officially broken.

In the third quarter, non-gaming apps not only maintained their previously captured leadership, but also increased their lead. Revenue in the “Non-Games” segment grew by more than 20% YoY, reaching $22.3 billion. This means that apps now account for about 52% of all consumer spending in the mobile environment.

This growth is almost universal and can be seen in all top categories, but two areas stand out in particular:

- Media & Entertainment: users are accustomed to paying for content and subscriptions.

- Generative AI: the generative artificial intelligence category has shown phenomenal growth—sixfold in a year, approaching $1.5 billion in quarterly revenue.

The most striking example of this trend is ChatGPT. In just one year, the app jumped from 16th place in the top revenue rankings to 2nd place in the world, now second only to TikTok.

Conclusion for promotion: if you work with utilities or lifestyle apps, now is the best time to implement and aggressively market AI features. The market is willing to pay for productivity and content.

Gaming market: stability and changing genre preferences

Mobile gaming, although it has lost its leading position in terms of growth rates, is demonstrating enviable stability. The sector had its second-best quarter ever in terms of revenue, falling just short of the peak reached during the 2021 pandemic. Growth was modest but steady at 2.5%.

However, there is a fierce rotation of genres within the segment:

- Decline of RPG: role-playing games are losing their position as the most profitable genre. This is directly related to the cooling of the Japanese and South Korean markets, where RPGs have traditionally dominated.

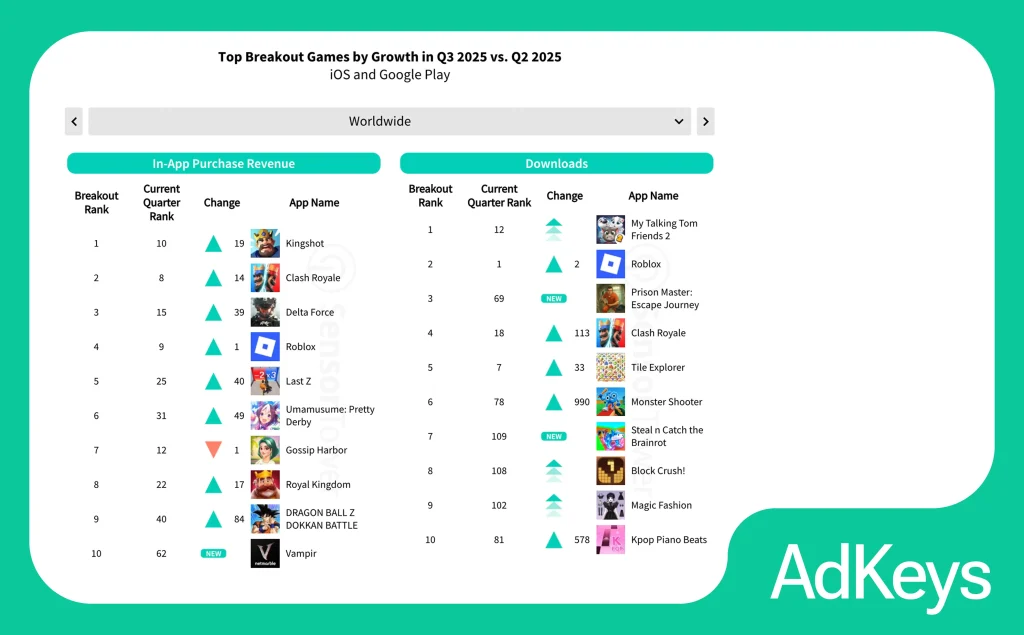

- The rise of strategy and puzzle games: these genres now offer the best opportunities for monetization. 4X strategy games (Last War: Survival, Whiteout Survival) and the new hit Kingshot have secured their place at the top.

- Casual games dominate downloads: when it comes to attracting traffic, simulators, puzzles, and arcade games are in the lead, with each genre accounting for approximately 20% of all game downloads.

Recommendation: when creating creatives for games, it is worth focusing on the mechanics of strategy and puzzle games, even if your game belongs to a different genre (misliding or the use of mini-games in advertising remains a relevant trend).

Stabilization of downloads

Overall, the global market for installations stabilized at $37.6 billion (+0.8% YoY) and shifted from a phase of extensive growth (“download everything”) to intensive consumption. However, non-gaming apps are growing faster than the market (+5.5%), spurred by interest in new AI tools.

The Geography of Money and Traffic

Understanding where to find users and where they are willing to pay is critical for setting up targeting.

Tier-1: The unshakeable US and growing Europe

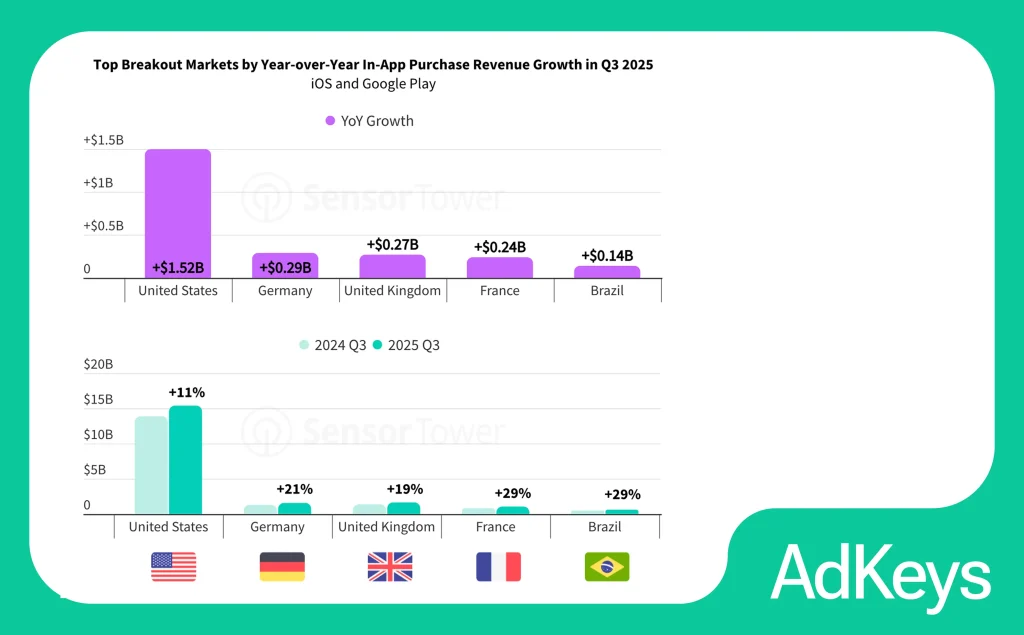

The United States remains the absolute leader in terms of revenue (IAP Revenue). The US market exceeds $15 billion per quarter, which is more than the combined revenue of the next five largest countries. Over the year, the US market has grown by $1.5 billion. Europe is also showing positive dynamics: the UK, Germany, and France have collectively added $800 million to revenue.

Brazilian breakthrough and Indian renaissance

Brazil: the market showed a 29% YoY revenue growth, becoming the fastest growing among the top 20 countries. Brazil is no longer just a source of cheap traffic but has become a paying market.

India: after a period of stagnation, India returned to growth (+7% YoY), adding 400 million installs compared to last year. This is the best quarter for the country in the last two years.

Japan remains the only major market with negative revenue growth (-1%), due to declining interest in traditional mobile games in the region.

UA strategy: to scale revenue (ROAS), the focus remains on Tier-1 (US, Europe). To scale user volume (especially for advertising monetization), Brazil and India are now priority geos.

Digital Advertising: New Channels and the Decline of the Shopping Category

The US advertising market grew by 12.1% in Q3 2025, approaching the $36 billion mark. The number of impressions exceeded 4 trillion, which is unusual for Q3 and signals a potentially record-breaking fourth quarter.

Key trends:

- The rise of in-app advertising. The fastest growing channel (after Reddit) was advertising within mobile apps. Advertiser spending here grew by 42% YoY.

- Reddit as a dark horse. Although volumes are still small, advertising spending on Reddit has grown by 46%, making it the most dynamic channel. Brands in the “Media and Entertainment” (+71%) and “Health” (+66%) categories are particularly active investors.

- Crisis in the Shopping category. The Shopping category has been reducing its advertising spending for three quarters in a row. The reason is macroeconomic: new tariffs in the US have hit the business models of Chinese giants Temu and SHEIN, forcing them to cut their budgets. However, in Q3, they began to recover, which indicates a new wave of competition for traffic in Q4.

- Gaming is aggressively buying again. The Gaming category broke into the top 5 in terms of advertising spending, showing a 28% increase. Game developers are sensing a market recovery and are willing to pay for users.

- Retail Media Networks (RMN). Amazon continues to dominate retail media, generating over 80 billion impressions — more than the other 30 top retailers combined (including Walmart and Target). 71% of these impressions occur directly on the Amazon website (Onsite).

Insight for media buying: in-App networks and Reddit are now growing faster than social networks (which are growing at only 11%). This makes them a must-have element of the media mix.

Breakthrough Verticals and Applications

An analysis of breakout apps provides insight into what is currently trending among mass users.

Artificial intelligence (AI)

As already mentioned, AI reigns supreme. Not only ChatGPT, but also Google Gemini and specialized applications such as Perplexity and Seekee are at the top of the download growth list. Users are looking for tools for productivity, learning, and content creation.

Short Drama

This is perhaps the most interesting content trend of the year. Apps with vertical micro-series (such as QuickTV and DramaBox) have become the fastest-growing vertical after AI.

For marketers: The format of short dramatic clips with cliffhangers (intriguing endings) works perfectly in advertising creatives, ensuring a high CTR. The success of this vertical proves that users have an appetite for “fast” entertainment content.

Streaming and Sports

The NFL (National Football League) season in the US traditionally drives the streaming market. Peacock TV and the official NFL app were among the top five in terms of revenue growth.

For marketers: P&G increased its advertising spending on OTT services by 58% to target parents through streaming platforms. This confirms the effectiveness of CTV/OTT as a channel for reach campaigns.

Auto insurance

Auto insurers (Geico, Liberty Mutual) showed an unexpected surge in advertising expenses, with growth of 316% and 205%, respectively. This is due to rising prices for cars and spare parts, which has forced consumers to seek more favorable insurance terms.

Final Recommendations From the AdKeys Team

Based on Q3 2025 data, we have compiled a list of practical recommendations to improve your performance:

- Invest in AI features. The sixfold growth of the Generative AI category is a signal. If your app has AI, highlight it in store headlines and in the first few seconds of video creatives.

- Revise your purchasing geography. Don’t just focus on the US. Brazil now offers a unique combination of volume and growing purchasing power (+29% revenue). Consider localizing your creative content and product for the Portuguese language and cultural characteristics of this region.

- Diversify your traffic channels. Meta and Google remain giants, but CPA is growing there. Pay attention to In-App networks (42% budget growth) and Reddit (+46%). These channels are showing high dynamics, which often correlates with the availability of high-quality and (as yet) unheated inventory.

- Short Drama-style creatives. Even if you have a utility or game, try using the Short Drama app approach in your creatives: live actors, dramatic plot, quick resolution. The success of apps like DramaBox proves that this format is great at holding attention.

- Hybrid monetization for games. Given the growth of the Strategy and Puzzle genres, as well as the popularity of “royal” themes (Royal Match, Kingshot), it is worth testing mechanics that combine deep strategy gameplay with the accessibility of puzzles (for example, through mini-games in advertising).

- Prepare for Q4. The US advertising market heated up in Q3 (a record 4 trillion impressions). The fourth quarter will be very expensive. If you have a limited budget, focus on more niche channels or regions with less competition (e.g., Tier-2 Europe or Latin America).

The third quarter of 2025 showed that the mobile market is alive, well, and growing. But the rules of the game are changing: AI is becoming the main driver of money, Brazil is the main driver of growth, and advertising budgets are flowing into mobile apps and niche social networks. Success in 2026 will depend on how quickly you can adapt to these changes.

Valeria Likhach, CCO