The mobile market continues to transform—according to Sensor Tower’s State of Mobile 2025 report, 2024 marks an important structural change, with app downloads declining for the first time in years (-1% YoY), while revenue and user engagement continue to grow steadily. This means that quality and retention are coming to the forefront, and the number of installs is no longer the key measure of success.

Leading categories such as social media, streaming, finance and AI are not only seeing revenue growth, but also increased global competition. Foreign publishers are increasingly entering local markets, offering innovative business models, personalization and unique user experiences.

Against this backdrop, it’s critical to understand

- which niches are growing fastest,

- which monetization models work in each of them,

- and which promotional tools are really driving growth.

In this article, the AdKeys Digital team will provides an analysis of the key verticals in the 2025 mobile market, with a focus on data, insights, and specific recommendations for developers, publishers, and marketers.

Macro Trends

✅ Decline in downloads and growth in consumer spending

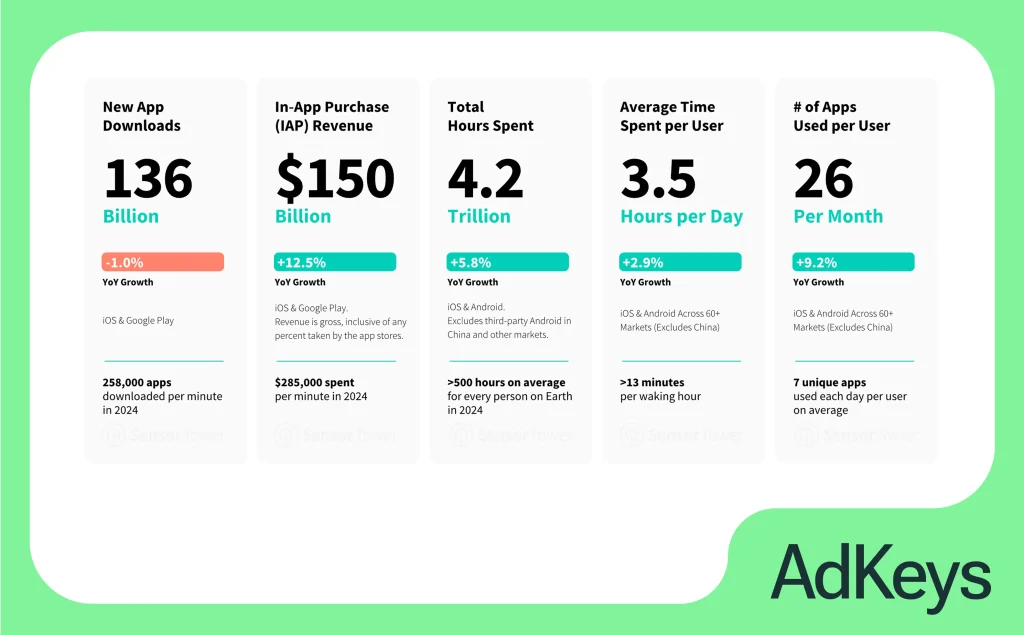

Despite the decline in downloads over the past four years (-1% YoY in 2024), consumer spending in apps continues to grow, reaching $150 billion (+12.5%), as does time spent in apps—4.2 trillion hours (+5.8%).

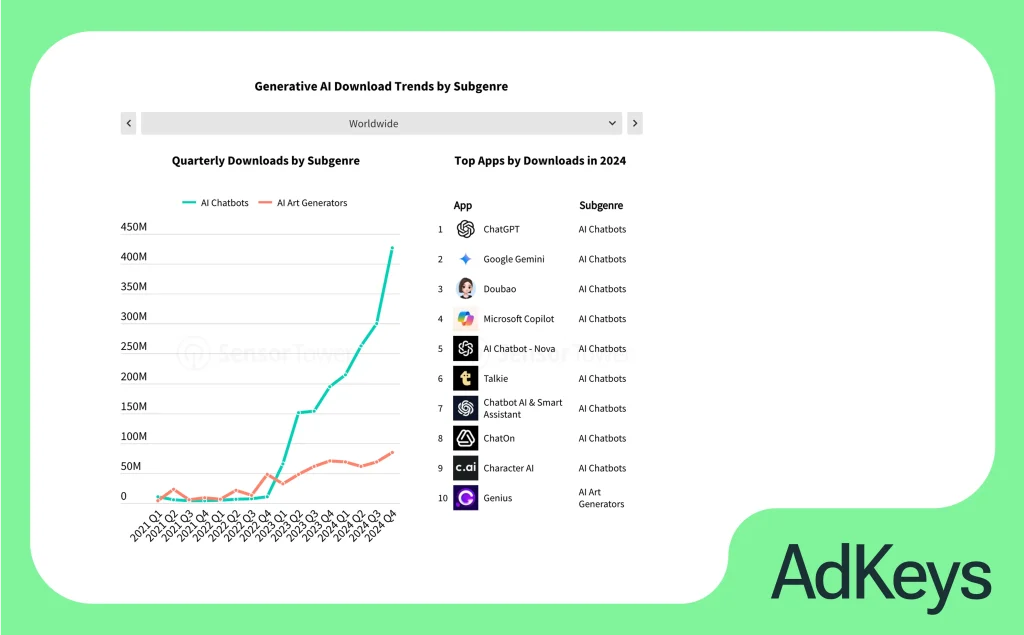

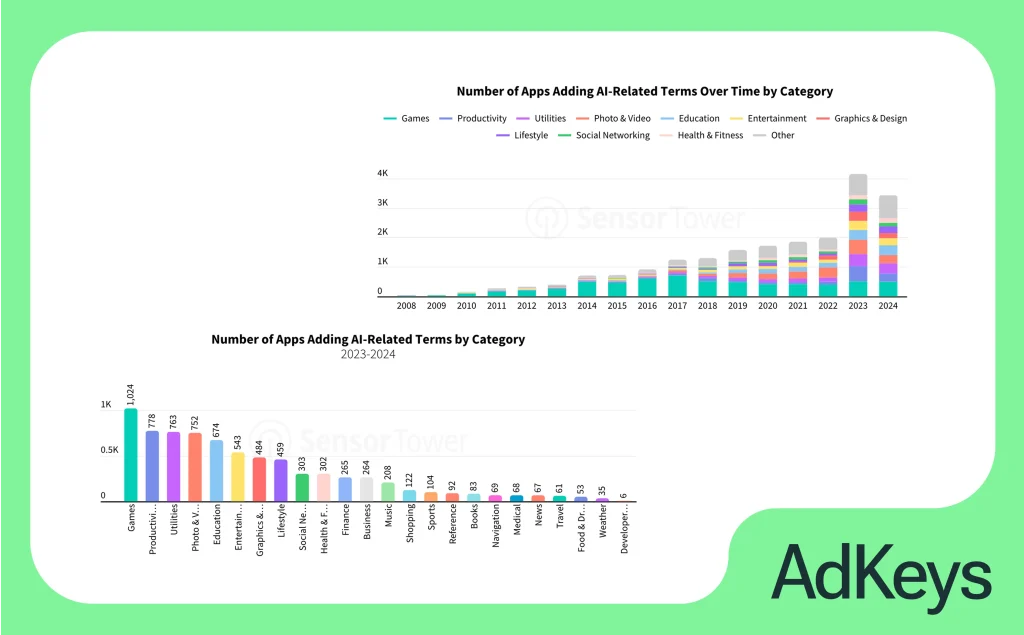

✅ AI apps are the fastest growing segment: +209% by revenue, +300% by time.

Chatbots with artificial intelligence (such as ChatGPT, Google Gemini, ByteDance’s Doubao, Microsoft Copilot) continue to show explosive growth in terms of both downloads, user engagement and spending. In addition, AI is becoming an integral part of applications across all verticals—from productivity and finance to social media and entertainment—offering new opportunities for automation, personalization, and content creation.

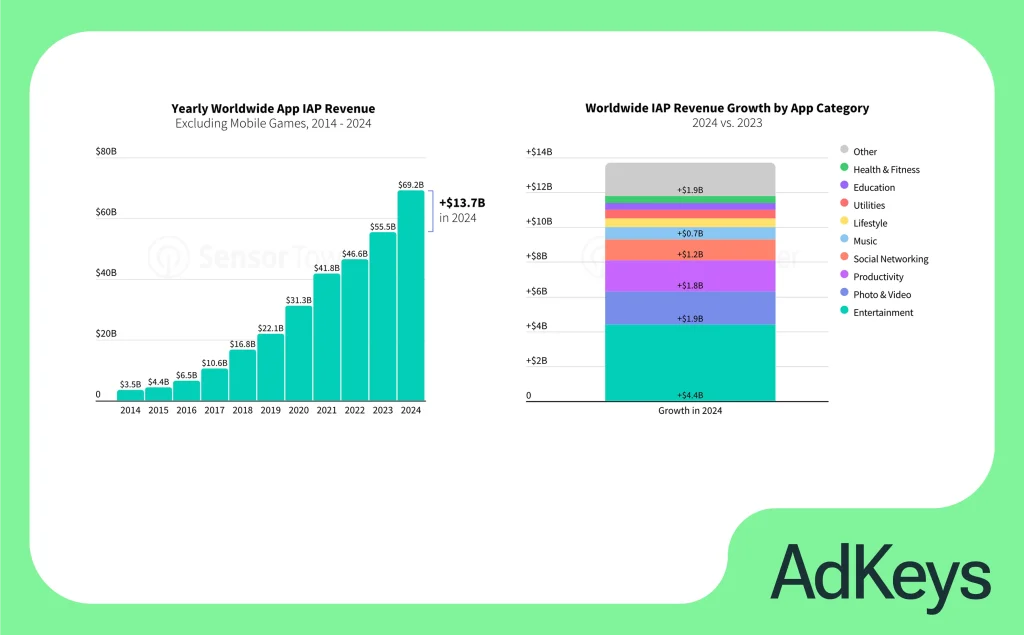

✅ Significant growth in consumer spending in non-gaming apps.

Revenues from non-gaming applications showed a year-on-year growth of +25%. Consumers are increasingly willing to pay for services across categories, with subscriptions becoming the main growth driver.

✅ Connecting mobile and the real world amidst digital fatigue.

Rapid growth is being shown by apps that help users in their real lives, offering a balance between the digital and physical worlds. Apps in categories such as travel, food and drink, sports and health are using mobile technology to enhance offline interactions, for example through food ordering, booking or workout management.

✅ Mobile gamification recovery.

Revenue from in-game purchases (IAP) grew 4% year-on-year, indicating a recovery in the gaming sector. Strategy, puzzle and action games are the most popular genres.

✅ Only 21-22% of downloads and spend remain in the countries of origin of apps—the market is globalizing.

Competition in the mobile market covers all regions, with apps developed outside traditional Western markets (e.g. Temu, TikTok Shop) showing notable growth. This emphasizes the importance of thinking globally and adapting products to the cultural and market specifics of different countries.

Key Niche Analysis

Gaming

The gaming vertical remains the largest in terms of consumer spending, with over $80 billion in total IAP revenue in 2024, despite relatively modest growth of +4% (YoY), while non-game apps grew +25%.

The interesting shift is the return of growth after the downturn of recent years.

Genres such as Puzzle, Strategy and Action are the most interesting to users, while the popularity of hyper casual games has declined.

In 2024, 11 games crossed the $1 billion IAP revenue threshold, including Whiteout Survival, Dungeon & Fighter, and Brawl Stars. That’s a record high since 2021.

At the same time, the average user is becoming more discerning. Competition is intensifying, and attention is only held by high quality, event mechanics, and personalized experiences.

Recommendations:

- Segment players by LTV and tailor in-game offerings: from casual to hardcore

- Use AI-analysis of player behavior to dynamically adjust difficulty, target offerers and manage churn.

- Develop UGC mechanics (maps, levels, in-game marketplace).

- Invest in event campaigns and collaborations (TV series, movies, cybersports).

- Use social features and metagame to increase engagement: guilds, PvP modes, ratings.

- International localization and regional campaigns (e.g. launch with national holidays).

AI Apps

Apps specializing in AI features (e.g., chatbots, image generators, intelligent assistants) are seeing explosive growth in downloads and engagement. Total revenue has grown from $30M (2022) to $1.3B (2024).

ChatGPT is leading the way with 40% of global consumer spending on AI apps and 23% of downloads in 2024. Apart from it, 25 other AI apps have crossed 10M downloads.

However, it is important to realize that AI is not a separate category, but rather a horizontal trend permeating all areas. Apps from different verticals are integrating AI, thus offering users innovative solutions that simplify tasks, automate processes, provide personalized content or improve user experience.

Recommendations:

- Integrate into other niches (fitness, finance, productivity).

- Use AI not only as a product but also as a marketing tool (personalization, segmentation).

- In promotion, emphasize demonstrating the unique AI capabilities and their practical value to the user.

Finance and Crypto

Financial apps are showing steady growth and recovery as global economic conditions improve. Digital wallets, P2P payments, and consumer banking are particularly strong in 2024. They are gaining popularity due to the convenience and speed of transactions. P2P apps specializing in international transfers show good dynamics.

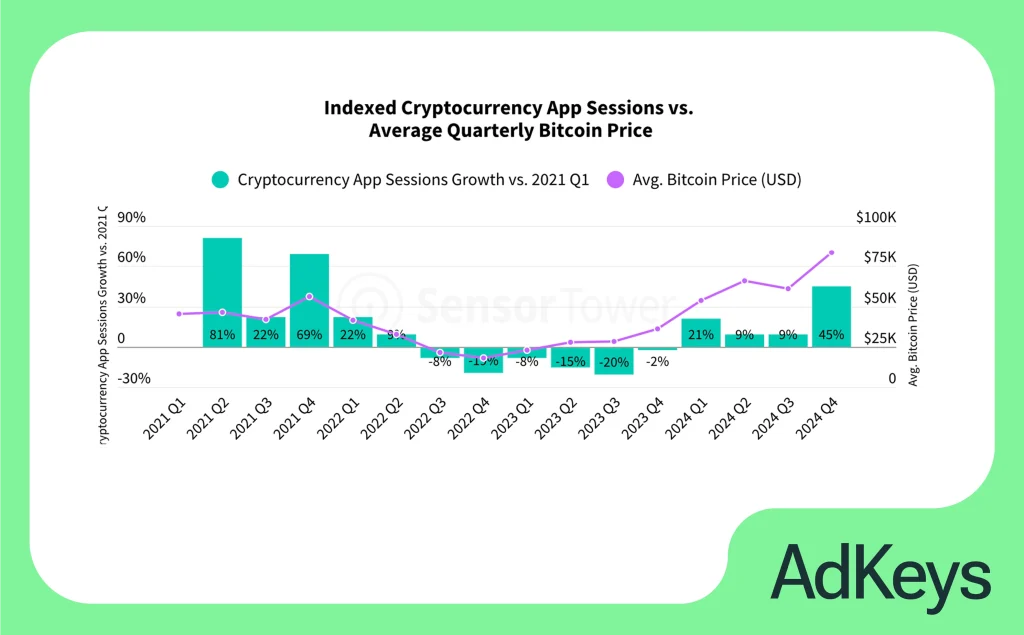

Cryptocurrency applications experienced a significant resurgence in 2024, surpassing the peak downloads of 2021. Total cryptocurrency app usage time grew +25% (YoY) and the number of sessions grew +37% YoY, with positive growth in every quarter, showing a strong correlation with the Bitcoin price.

Recommendations:

- Simplify UX and educate users.

- Emphasize safety, security, reliability, innovation, as well as improving financial wellbeing and providing new investment opportunities.

- Integrate with e-commerce (in-app payments).

Shopping

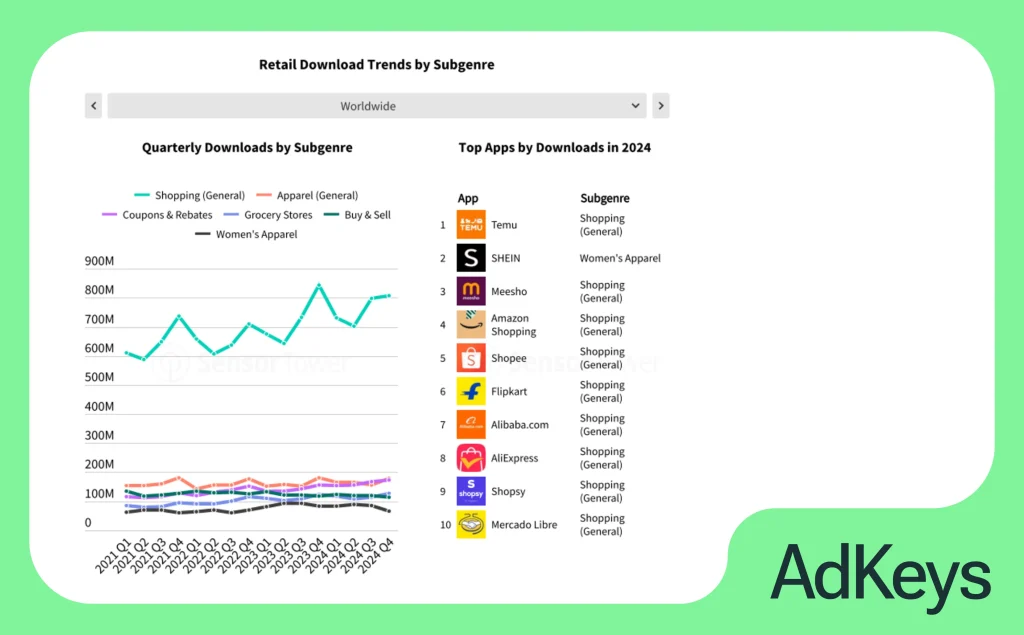

The category is showing growth, with players like Temu and TikTok Shop changing the rules of online shopping. “Temu” leads the world in terms of downloads in 2024, followed by “SHEIN”.

The globalization of retail apps is taking place. Although the market is still quite regional: most major markets (e.g. Mainland China, Japan and India) receive a large share of downloads (at least 70%) from domestic publishers, and globally the United States leads with leading apps such as Temu (headquartered in the US) and Amazon. However, competition from foreign retail apps is increasing in most markets, including Brazil, India and the US, and the share of local publishers has reached its lowest level in four years. “Temu and SHEIN are particularly increasing competition in the US and Europe.

There is rapid growth in Southeast Asia and Latin America.

Female audiences remain key, accounting for up to 70% in selected shopping app categories.

Recommendations:

- Aggressive marketing, viral campaigns, heavily discounted offers, wide assortment of products

- App of AI for recommendations and dynamic discounts.

- TikTok and Instagram as engagement channels.

Video and Streaming

Video streaming apps continue to lead the way in consumer spending. In 2024, streaming services such as Disney+, Netflix and Max are at the top of the list in terms of IAP revenue. Unlike social media, where monetization is driven by donations and content promotion, video streaming still predominantly uses a subscription model.

An interesting trend is the diversification of players: no single streaming app dominates the overall revenue structure, with nine apps sharing 3%+ of revenue each.

Time spent in these apps remains consistently high, especially in countries with developed digital infrastructure, but growth is slowing down due to saturation and competition.

Recommendations:

- Use hybrid monetization models: subscription + rental/purchase of individual films, exclusive content.

- Develop interactive features (polls, live chats, co-browsing).

- Implement AI-recommendation systems that adapt the feed to the user’s preferences.

- Localized content and subtitles to increase reach in new markets.

Social

Social apps remain the absolute leaders in time of use, with over 2.4 trillion hours in 2024. TikTok and YouTube are the main drivers of this engagement (TikTok is the absolute leader in terms of revenue, YouTube in terms of view duration), with TikTok demonstrating a unique approach to monetization through embedded donations, boosts and advertising within content.

Interestingly, social media are actively adopting AI features: from automatic video editing to generating descriptions.

The activity is especially high among Gen Z, who choose Instagram, Discord, Snapchat.

The average age user spends more time on Facebook, WhatsApp, Pinterest.

Recommendations:

- Active gamification of social mechanics: badges, Challenges, level achievement.

- Create monetizable UGC (user-generated content) and support creators through in-game tokens.

- Testing paid subscriptions for exclusive features (example – X Premium).

- Collaborations with Influencers and building brand communities.

Food & Drink

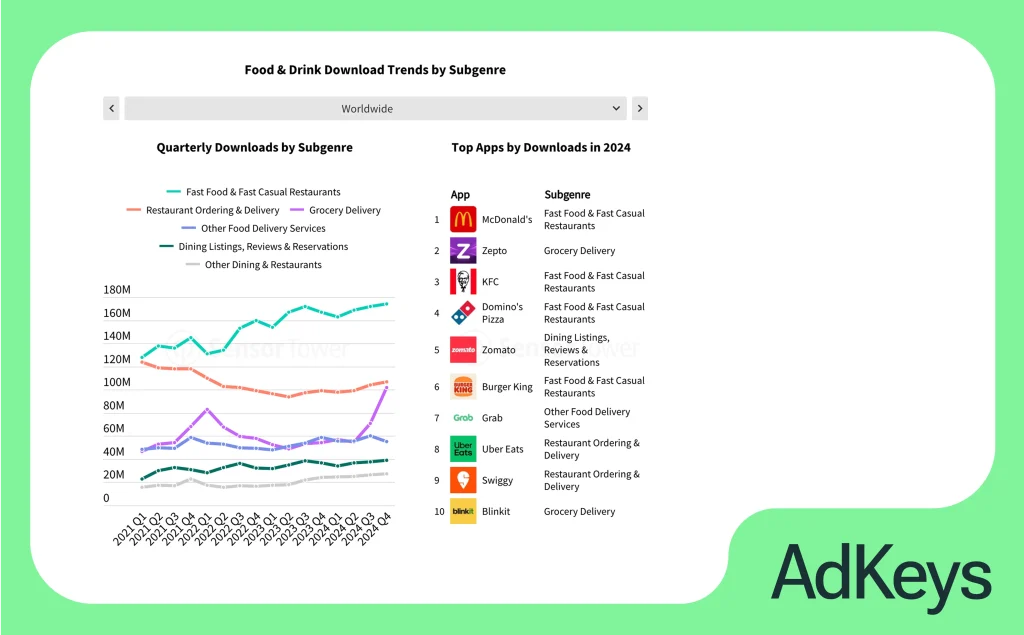

Apps from the food category are showing strong growth, especially in developing countries. The main driver is delivery services and user loyalty through cashback and bonus systems.

Traditional players such as Uber Eats, DoorDash and Grab continue to grow their reach, but localized competitors with more niche offerings are also emerging.

Recommendations:

- Implement AI menus and recommendations based on order history, time of day and weather conditions.

- Delivery subscription (“free delivery pass”) and prepaid meal packages.

- Integration with fitness/health (e.g. calories, diet).

- Use push notifications based on geolocation and time—e.g. lunch nearby.

Health & Fitness

Fitness apps, especially in the meditation, workout, and activity tracker segments, are maintaining their growth momentum. Strava, MyFitnessPal, and Headspace apps showed revenue growth of 15-20% in 2024.

The solvent audience is users aged 35+. Time spent in such apps has also increased, especially in APAC and Europe.

Recommendations:

- AI coaches: personalized training plans that adapt to progress.

- Combined monetization models: basic free functionality + paid access to programs and experts.

- Built-in competitions and Challenges to increase engagement.

- Integration with wearable devices and health tracking platforms.

Travel

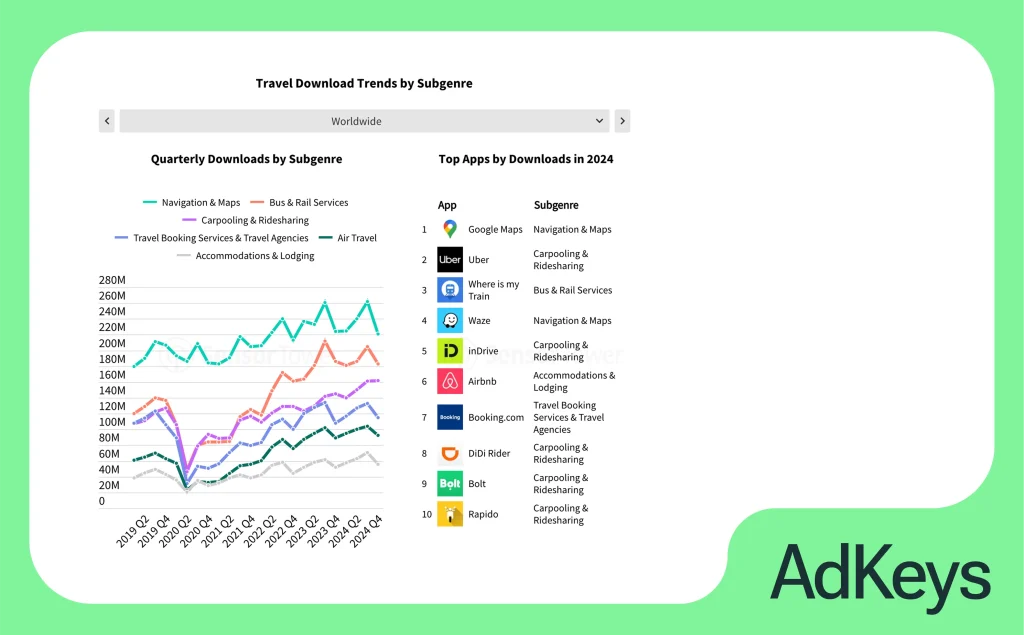

The travel category is actively recovering from the pandemic downturn. There is strong growth in bookings, navigation, airfare and hotel searches in 2024. The leaders are Booking.com, Airbnb, Google Maps.

The largest increases are in Asia-Pacific and Latin America. Users are increasingly looking for flexible and personalized itineraries based on preferences and current situation.

Recommendations:

- AI guide integration and automatic route generation.

- Support for local content, offline maps and AR objects.

- VIP access subscriptions (early check-in, priority booking).

- Expansion of “after-trip” features: reviews, albums, memories.

Prospects and Challenges

Opportunities:

- AI innovation: The continuous evolution of AI opens the door to creating entirely new types of apps and features that were previously impossible.

- Growth of paid services: Increasing consumer willingness to pay for quality non-gaming services creates huge potential for subscription revenue growth.

- Merging online and offline: Apps that effectively merge digital capabilities with the real world will have an advantage.

- Global reach: Untapped markets with a growing number of mobile users represent a significant opportunity for expansion.

Challenges:

- High competition: The market remains extremely saturated, making it difficult to distinguish and attract users.

- Changing data privacy: Increasing privacy regulations (e.g., Apple’s ATT) make targeting and measuring ad effectiveness more difficult.

- “Digital Fatigue”: There is a need to offer solutions that do not overload with information, but instead simplify the user’s life and balance their digital and physical reality.

- Rapidly changing technologies: It is important to constantly adapt to new technologies (AI, new content formats) and changes in user behavior.

The mobile app market in 2025 is a competition for engagement and solvency. The user has become more selective and the competition is more global. Success goes to those who don't just make "one more app" but provide real value to users, build an ecosystem of habits and personalized experiences.

Valeria Likhach, CCO, AdKeys Digital